Interviewer: Yes, this will be consumer first. Me: There are merchants as well who use Google Pay but for this let's keep the scope limited to consumers as businesses have their processes when it comes to payments and finances. Me: Is it safe to assume that it will be a mobile feature for users who already have an account with Google Pay? Me: Since this is a service primarily in India, I’d like to limit the scope to India as a country, though it can be expanded to other countries later. With the number of credit card holders increasing every year and services like BNPL becoming increasingly popular, the direction above seems precise.

The more seamless transactions a user can do, the more likely it is for them to stay on the platform. The goal of this feature is to register Google Pay as a default payment method for anything and everything. Today most people use Google Pay to pay at shops, for deliveries, and for some recurring bills like the internet.Ĭredit card holders belong to a segment considered to have higher purchasing power which makes charging a premium for their eyeballs justifiable. Me: I want to first start with the “Why?”. Let’s structure this article as an interview simulation. These incentives include offers from brands along with usual cashback. Google Pay also has a rewards feature where it randomly incentivizes you for transactions you make. The application is clean and easy to use and therefore has made its in-roads to even the less tech-savvy. The goal of Google Pay is to make money simple. Reliance JIO made the internet accessible to millions of people in India and the global pandemic accelerated the adoption of online payments.

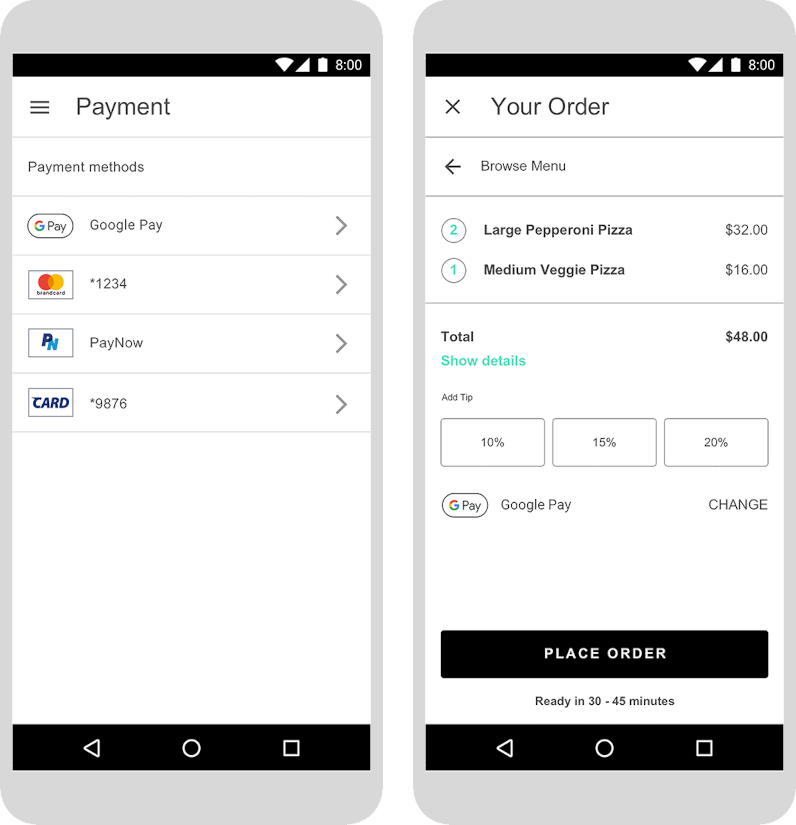

Google Pay is a free mobile payment system from Google that uses UPI to make instant payments between users and businesses. Design a feature for paying credit card bills.

0 kommentar(er)

0 kommentar(er)